are union dues tax deductible in california

Funding sources include membership dues. Alabama also allows deductions on certain job-related expenses such as travel and transportation expenses union dues and uniform costs for which your employer hasnt reimbursed you.

What Are Payroll Deductions Article

A portion of your dues payment will be shared with your local chapter.

. It targeted deductions like union dues and some medical costs. California tax is a separate state-imposed tax on income you earned while working in a specific state. Discount I saved roughly 1200 on a lawyer when I adopted my daughter last year.

As well as union dues and work clothes. For more information see Preparing and filing your tax return under How To Get Tax Help. Some states California for example continue to provide this tax deduction after 2017 so even though you might not get a break on your federal taxes you.

Elderly and Disabled Credit. However you cannot deduct the portion of the fees that pays for sick accident or death benefits or for a pension fund even if the fees are required dues. A deduction is also given for any child andor spousal support.

A non-refundable tax credit available for taxpayers who are aged 65 or over or who are permanently and totally. Employees at Nirvana Soul a Black-owned coffee shop that opened in the SoFA district during the COVID-19 pandemic announced plans to unionize Thursday during the cafes weekly open mic event to more than 100 peopleWorkers told San José. The PPO organtissue transplant network for all members is LifeTrac.

California court is a no-fault state which means the court does not need to find that one spouse is at fault for the breakdown of the marriage. While the tax credit is still subject to future budget action floor reports from the Legislature provide a few details about what the. For the VITATCE site nearest you contact your local IRS office.

Union dues and expenses. You incurred the. Tax reform changed the rules of union due deductions.

Thats three years worth of my tax-deductible union dues. The cost of her health insurance premiums in 2021 is 8700. Union leaders said the issue is years in the making and the result of city leaders failing to address chronic staffing issues.

Use Adjusted Gross Income line 37 on form 1040 Note. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions.

Private sector for-profit companies. Here are some other business expenses employees can deduct on their tax return. Union Plus benefits offered by the AFL-CIOs Union Privilege provides consumer savings discounts.

Youre donating to PayPal Giving Fund a 501c3 charity subject to its termsDonations can take up to 45 days to get to your chosen charity. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Includes key targeted tax relief measures including the following.

Grants from local state and federal agencies as well as. These programs provide free help for low-income taxpayers and taxpayers age 60 or older to prepare and file their returns. Advance payments of the premium tax credit of 4200 are made to the insurance company and Amy pays premiums of 4500.

Movement Builders DSAs monthly dues program helps support chapter trainings new chapter start-up member support and YDSA. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense. The sale of goods and services.

Your own HSA contributions are either tax-deductible or pre-tax if made by payroll deduction. Fords F-150 Lightning electric pickup truck costs 46974 compared with a base price of 32000 for a traditional model. Volunteer Income Tax Assistance and Tax Counseling for the Elderly.

Its rare but if we cant send your money to this charity well ask you to recommend anotherIf we cant reach you well send it to a similar charity and keep you updated. - -- --- ---- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- ----- -----. It added the personal exemption state and local taxes and the standard deduction back to income.

Annual Recurring Membership Dues will be billed recurring annually Single Year Membership. While union dues are currently tax. PayPal covers all transaction fees.

The PPO dialysis network for all members is the Preferred Outpatient Dialysis Network. According to city officials the police unions latest proposal is a 14 pay increase over two years8 in 2022-23 and 6 in 2023-24and a 5000 bonus. The IRA contains 30 billion in tax credits over the next ten years for nuclear-power subsidies.

Union dues and deductions for unreimbursed expenses by your employer no longer deductible. OPEIU Local 2 Benefits that fit your life. On her 2021 tax return Amy is allowed a premium tax credit of 3600 and must repay 600 excess advance credit payments which is less than the repayment limitation.

Dues to professional societies excluding lobbying and political organizations. Develops the Workers Tax Fairness Credit to turn union dues from being tax deduction into a tax credit. The police union is in contract negotiations with the city.

Allowances are made for mandatory deductions such as federal and state taxes and health insurance premiums and union dues paid. Money Home Auto Shopping Discounts. Reagans AMT tax reform eliminated the more exotic investment deductions that had been used predominantly by the very wealthy.

If California moves to enact future legislation it will change Californias tax deduction for union members into a tax credit meaning taxpayers would be subsidizing a portion of union members dues. In addition to school-related unreimbursed employee expenses you can include union dues investment expenses tax preparation fees and certain other expenses to get over the 2 threshold. Drivers pay more for less-convenient mobility.

O Workers Tax Fairness Credit. In any case electric vehicles have practical problems. Also even though unreimbursed.

There are no membership dues for the Year 2022. In California the limit is higher a home mortgage is deductible to a maximum of 1 million. Dues will be billed recurring monthly.

Changes are brewing at a downtown San Jose coffee shop as workers form a unionwith the owners blessing. To qualify for this deduction you need to meet the following requirements.

6 Overlooked Tax Deductions And Credits That Could Score You A Big Return National Globalnews Ca

Top 22 1099 Tax Deductions And A Free Tool To Find Your Write Offs

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

Tax Write Offs For Athletes Awm Capital Awm Capital

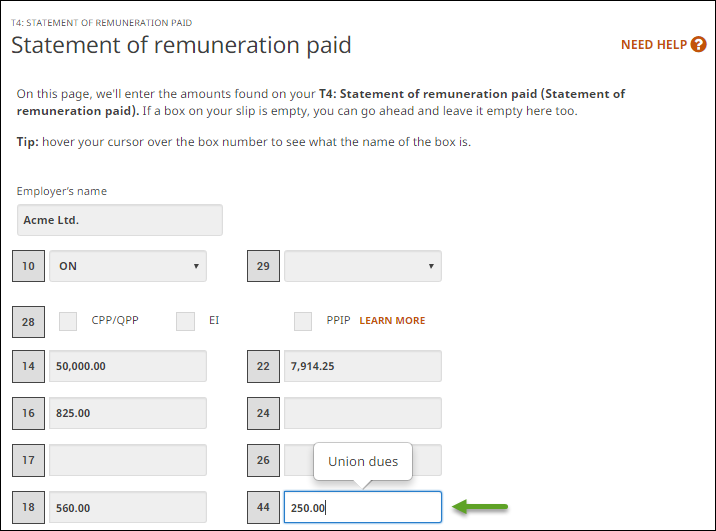

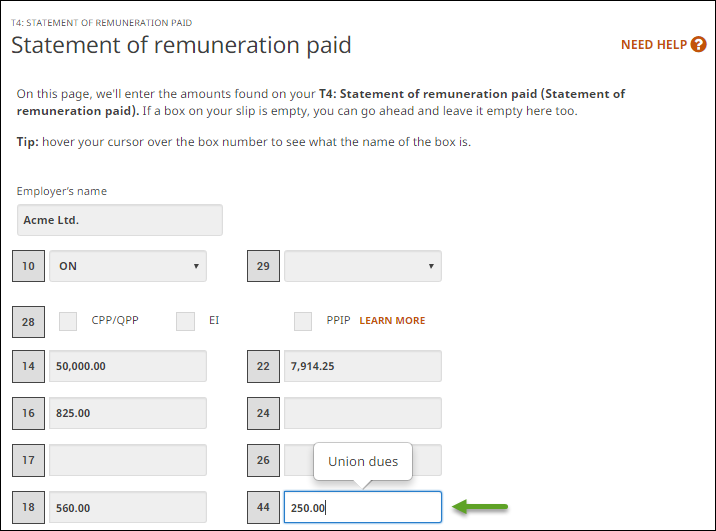

Where Do I Enter My Union And Professional Dues

Union Dues Are Now Tax Deductible Foa Law

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

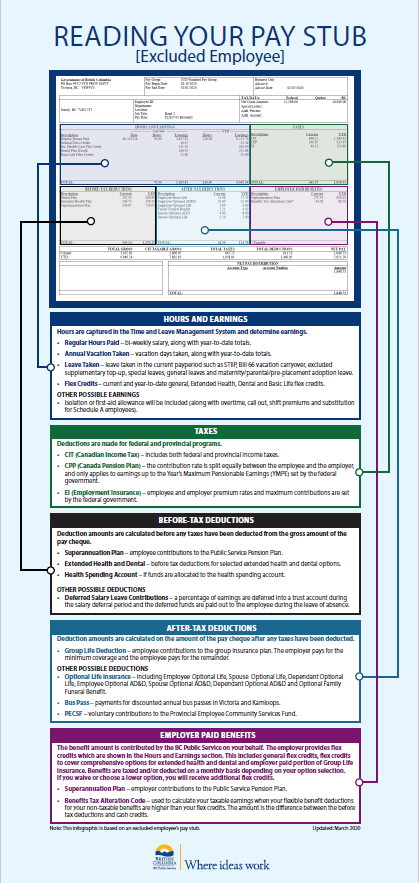

How To Read Your Pay Stub Province Of British Columbia

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

What Are Post Tax Deductions From Payroll Types Examples More

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

Different Types Of Payroll Deductions Gusto

Download Bonus Paystub Template 01 Paycheck Prepaid Debit Cards Paying

A Tax Break For Union Dues Wsj

What Are Payroll Deductions Article

Tax Deductions Struggling With Us Taxation What Can A Non Citizen Silicon Valley Software Engineer Earning 100k Expect To Take Home Quora